Loading...

Case study – Responsible Fixed Income Investing – Learning from the best

Sculpt Partners benchmarked ESG practices of a leading Indian alternative fixed-income manager and trained the investment team to enhance existing practices

Challenge

- Leading fixed income manager and subsidiary of one of the most reputed family-owned financial institutions in India

- Implemented many progressive ESG policies and programs to integrate ESG lens into the investment life-cycle

- However, unable to make meaningful impetus in attracting ESG-aligned overseas institutional investors and family offices as Limited Partners (LPs) for its recently launched fixed income fund on affordable housing

Our approach

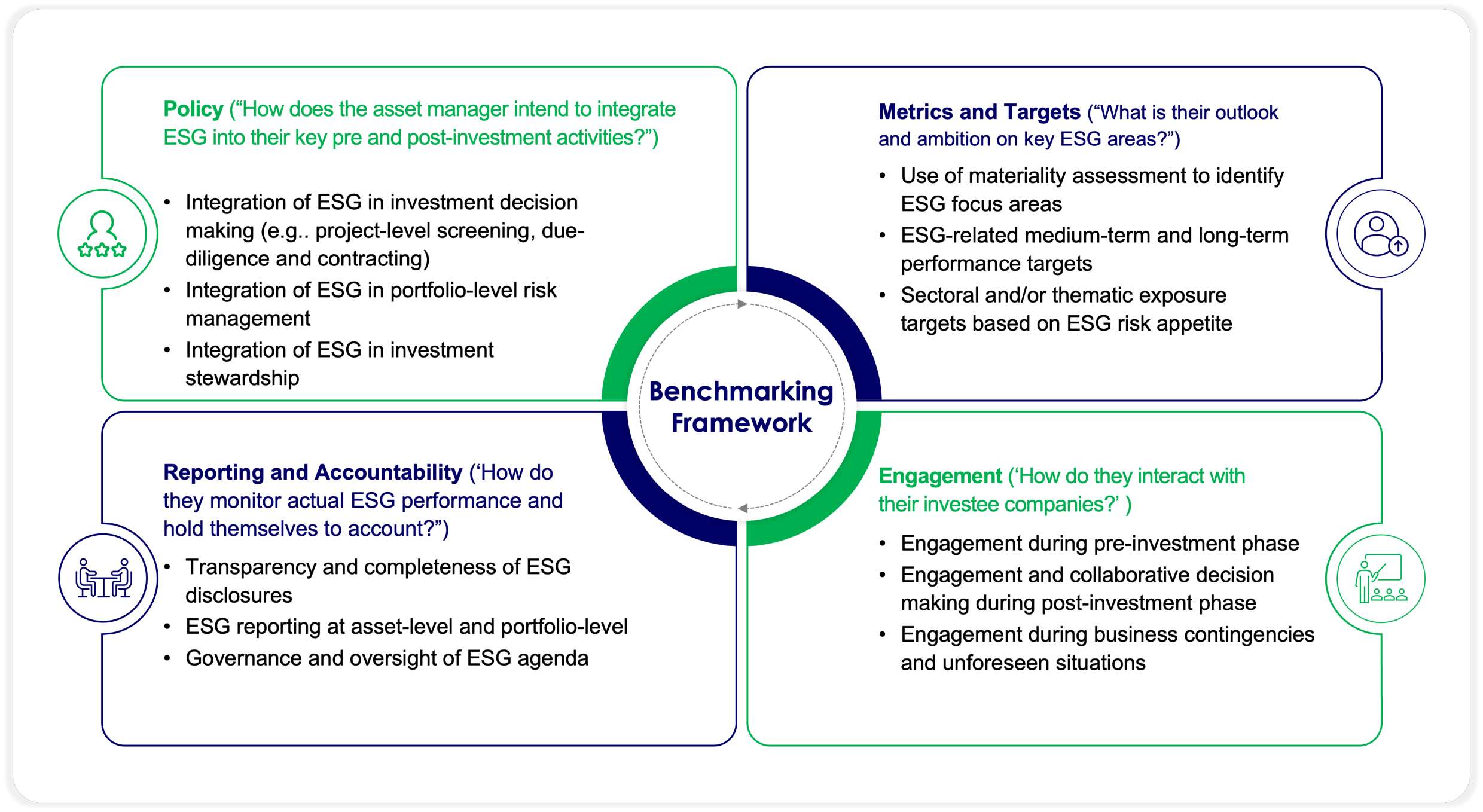

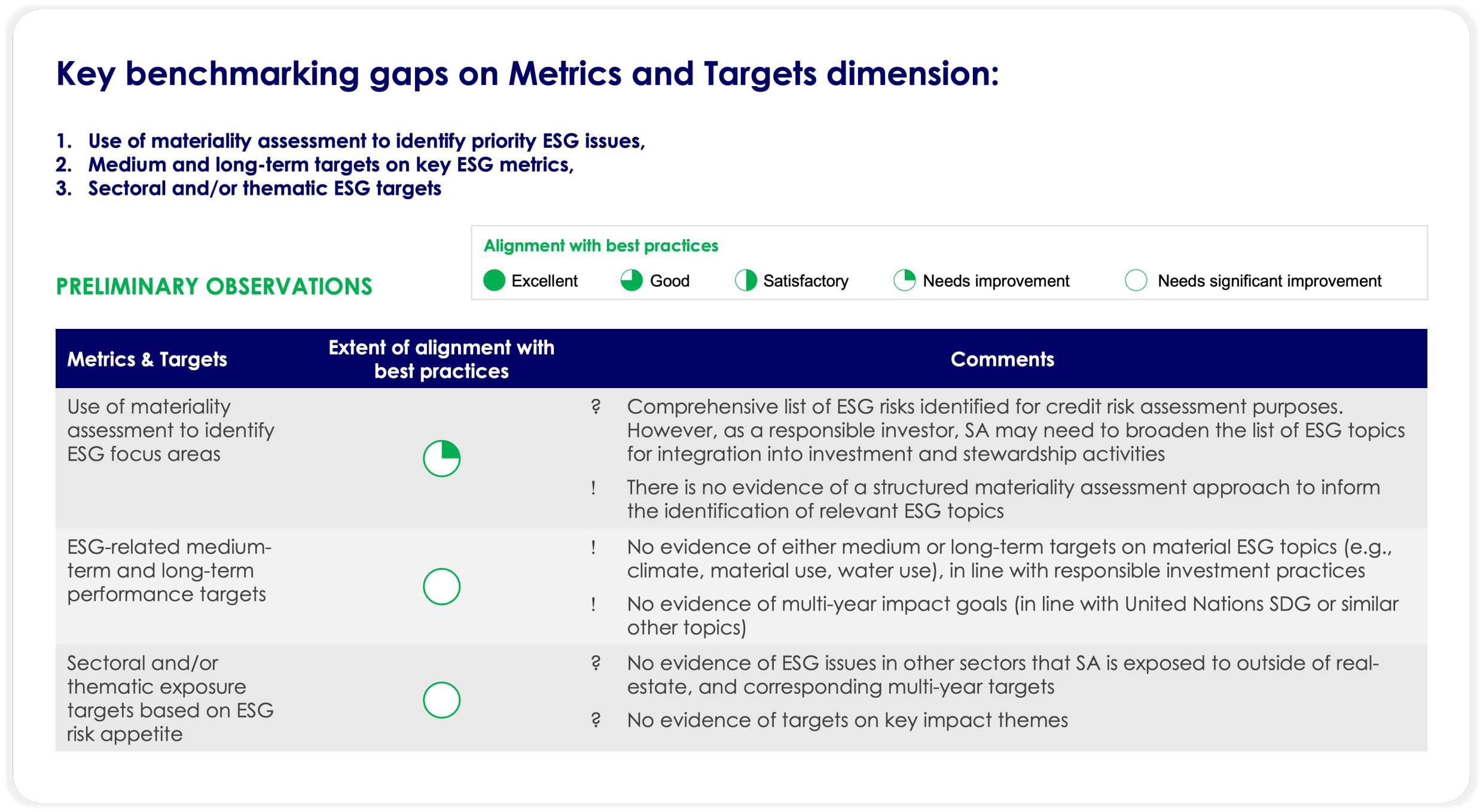

- Benchmarked asset manager’s current ESG policies and practices comprehensively based on four dimensions – Policy, Metrics & Targets, Engagement, Reporting & Accountability

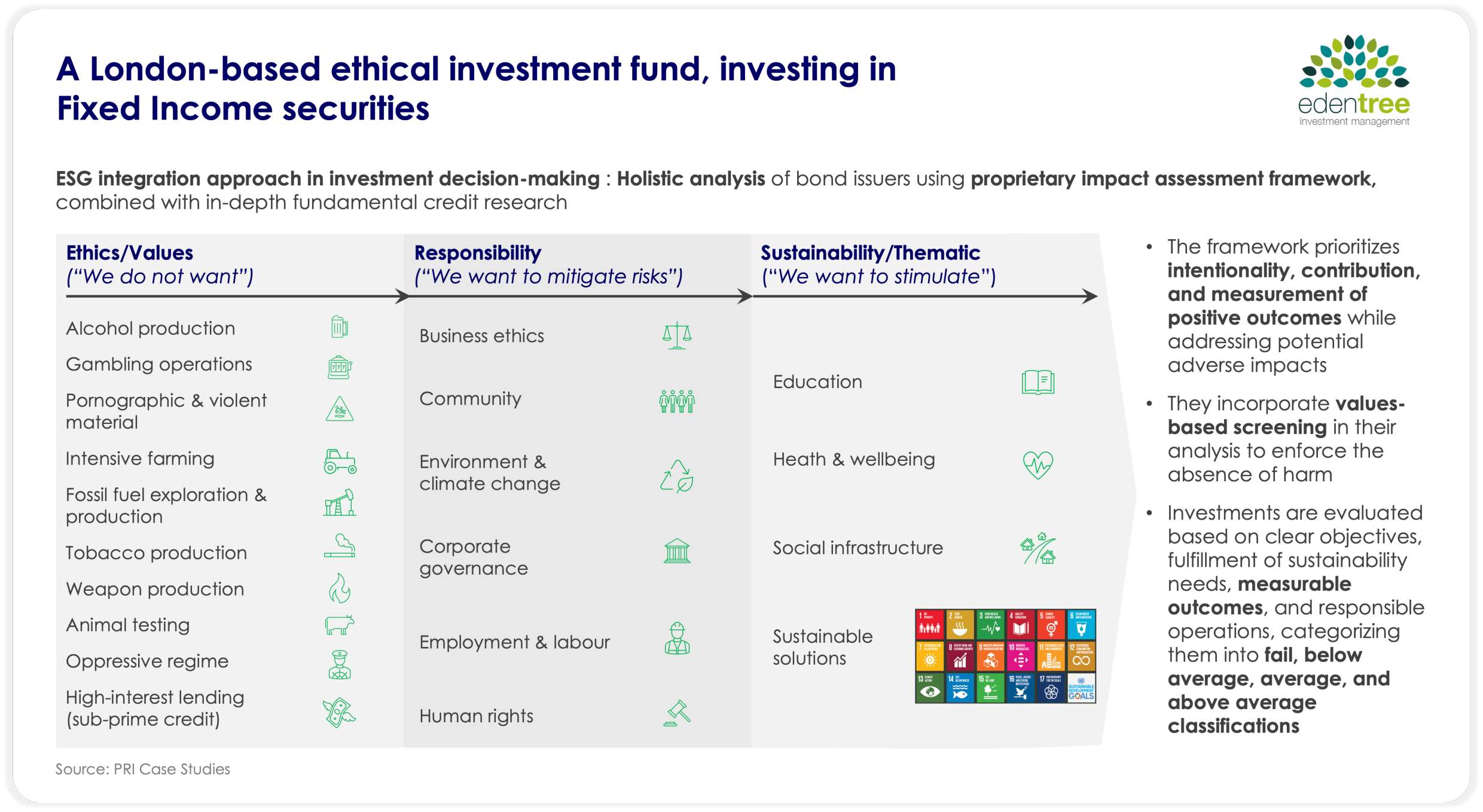

- Substantiated current gaps by drawing insights from global best-in-class fixed income managers

- Developed a six-pronged recommended action plan covering ESG policy, risk assessment, targets, investee engagement, reporting and advocacy

Subscribe

Login

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments