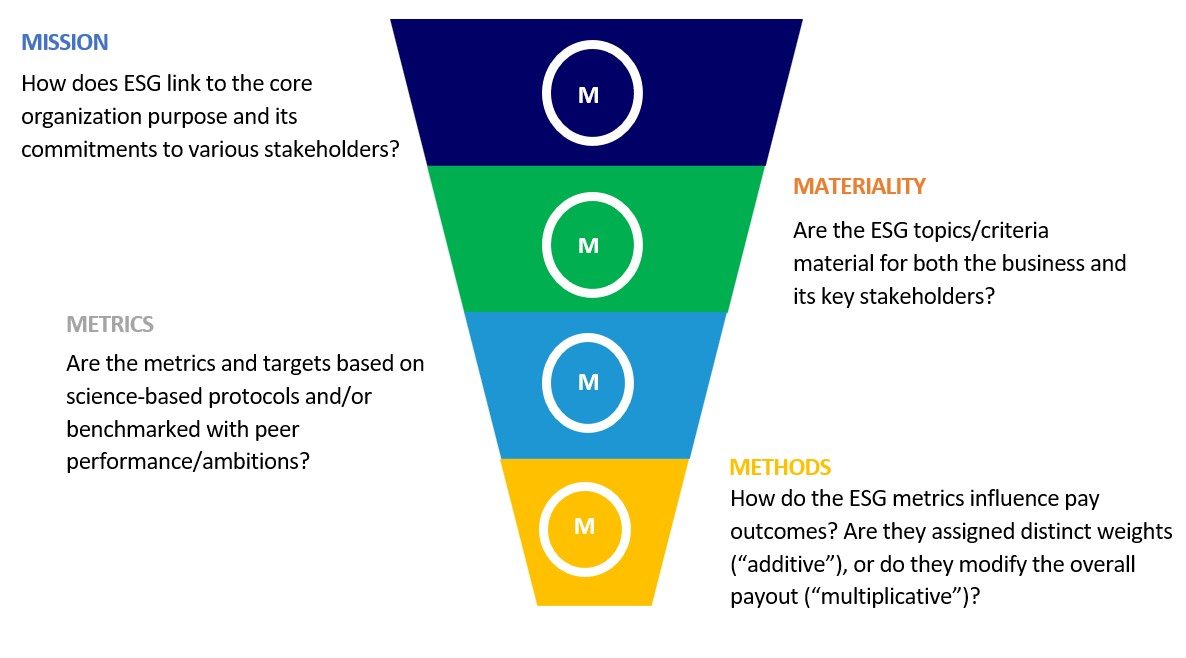

1. Mission

I use mission interchangeably with the organisation’s core purpose and its commitments to stakeholders. Boards should strive to gain common ground on how ESG contributes to the organisation’s mission. This is vital before delving deeper into design issues such as metrics, targets and pay-performance linkages.

Danone, the global food and beverages company, identifies four levers that underpin its commitments to co-build a healthier future – health, planet, inclusive growth and people. The annual variable compensation of top executives has measurable social and environmental indicators linked to achievement against these commitments, with a total weighting of 20%. Danone has also integrated performance into its variable compensation system for 1,500 senior executives. In comparison, ESG criterion accounts for 30% weighting in the vesting of the firm’s long-term incentive awards, and is measured based on the three-year historical average environmental score awarded to Danone by CDP (Carbon Disclosure Project), a global disclosure and rating provider.

2. Materiality

Materiality can be both financial (i.e., how does ESG impact my business’ bottom line?) or stakeholder (i.e., how does my business impact the environment, communities, employees, customers, suppliers or government?). Boards must invest in a materiality assessment exercise to identify and parse the ESG topics that need to be reported, managed and overseen. They should prioritise only the most material ones for target-setting and incentivisation. While doing so, they should also resist the clarion call from investors or other stakeholders to include topics (such as Greenhouse Gas emissions) that may not be relevant to all firms. If it is not material, it should not be in the scorecard.

The Long-Term Incentive Plan (LTIP) of Adidas, the German headquartered apparel manufacturer features only one ESG metric with a weighting of 20% viz. share of sustainable articles, with a target of achieving 90% of the overall portfolio (by weight) by 2025. Sustainable articles are largely made of recycled materials and Adidas defines them based on prevalent industry standards and principles. This metric closely dovetails with the firm’s materiality assessment which identifies innovative sustainable products and ethical supply chain practices as the most material for both the business and the stakeholders. Further, the ESG performance will be subject to an audit based on ISAE 3000 standards (a prevalent standard for verifying non-financial performance data) by an external auditor.

3. Metrics

Once relevant ESG topics have been identified through mission alignment and materiality analysis, the next step would be to drill them down to relevant Key Performance Indicators (KPIs) and annual/multi-year targets. ESG metrics are more commonly used in annual bonus plans, but there are many ESG goals that fit better under a multi-year time horizon. As a case in point, consider the ESG topic relating to decarbonisation. The Science Based Targets Initiative (SBTi) is currently the most commonly accepted standard to benchmark enterprise decarbonisation targets over the medium-term (until 2030) and over the long-term (until 2050). Should the long-term incentive incorporate any multi-year targets on emissions reductions, it would be logical for such targets be linked to the SBTi protocol. Similar such science-based targets are also available for other important ESG topics such as land, fresh water and ocean use, bio-diversity, etc. Science Based Targets are evidence-based commitments adopted by companies to reduce their impacts in line with what the latest science says is necessary to meet global goals and stay within planetary boundaries, such as limiting global warming to 1.5°C.

Where science-based methodologies do not exist (e.g., Diversity goals, Human Rights) we recommend that corporations use resources such as the UN Sustainable Development Goals (SDG) 2030 to calibrate their multi-year targets. They can also refer to best-in-class peer practices within or outside their industry.

Starting 2020, CapitaLand Investments, one of Asia’s leading real-estate asset managers listed in Singapore, introduced carbon emissions intensity reduction as one of the four performance conditions that will decide the vesting of their performance share awards (others being absolute shareholder return, relative shareholder returns and return on equity). The emissions intensity reduction targets are set over a three-year rolling period, and are derived from the firm’s 2030 SBTi based decarbonisation goals to reduce Scope 1 and Scope 2 emissions by 46% and Scope 3 emissions by 22% (using 2019 as the baseline year).

4. Method

The final step (and perhaps the most important for the compensation practitioner) is to establish a suitable pay-performance link between ESG performance and executive pay. The most common approach is to incorporate ESG criteria in the corporate, division or individual unit scorecards that determine the annual incentive. Almost two-thirds of the S&P 500 companies that have ESG-linked incentive plans use this approach.

Incorporating ESG criteria in long-term incentive plans is still in its infancy, as companies start to better grasp the nuances associated with long-term ESG target setting. However, they find favour with most institutional investors. A 2021 study conducted by Institutional Shareholder Services (ISS) revealed that more than four out of every five investors endorse Boards to introduce ESG criteria in their long-term incentives. However, it is also important to note that embedding ESG criteria in long-term incentive should not come at the expense of diluting the link between pay and shareholder returns. In other words, ESG should not be seen as a “crutch” to boost award vesting when shareholder returns are below expectations. To pre-empt such scenarios, Boards can consider adopting a mechanism where interim vesting outcomes are derived from financial results first. Subsequently, an ESG performance multiplier can modify the vested awards upwards or downwards to arrive at the final award outcome. In any case, Boards should carefully evaluate all possible alternatives to link pay to ESG performance, conduct scenario-testing of such alternatives and choose the one that best preserves the pay-performance integrity under all scenarios.

British Petroleum (BP), the global oil major incorporates ESG metrics in the executive pay structure in multiple ways. Safety and Environment related KPIs account for 40% weight as part of the corporate scorecard that determines annual bonus. Low carbon energy transition accounts for 30% of the performance criteria that determines vesting of long-term incentive awards over a three-year period. Lastly, any material environment and safety failures can invoke a “malus” clause, leading to cancellation or reduction of all unvested awards.

In conclusion

Tightening the alignment between ESG and executive compensation arrangements is a topic of growing investor interest. However, implementation is still at its infancy and best practices are only starting to evolve. Boards would be well-served to adopt a systematic approach that is purpose aligned, material, science-based and underpins pay link to shareholder value. They should also treat any approaches propounded by ESG rating agencies with a pinch of salt.

Very insightful.We were exploring the idea of incorporating ESG in executive compensation. However, we are at the initial stages of ensuring a robust ESG framework with well defined measures that we want to measure over a longer time frame. Once we mature in identifying the right metrics and measuring them, we will incorporate them in exec pay

Thanks Neha. Keen to hear from you on the progress of your ESG implementation initiatives and your efforts to link these to executive remuneration. All the best!